The Financial Aid College Financing Plans is designed to help you understand the costs of attending Keiser University and how possible financial aid for which you might be eligible can help offset some of the cost. You will be asked a few questions to help determine your financial and living situation so the best possible information can be provided to help make your decision about attending Keiser University and how you will finance your education.

Please call the Campus Financial Aid Office for due dates on your FAFSA as it relates to your program.

The main criterion for receiving grants is substantial financial need. Grants do not have to be repaid unless a student becomes ineligible. Students must maintain satisfactory academic progress as defined in the Keiser University Satisfactory Academic Progress Policy.

Federal Pell Grant is a federal grant awarded to students on the basis of financial need and does not have to be repaid. These grants are considered the foundation of federal financial aid, to which aid from other federal and non-federal sources might be added. Pell Grants are only awarded to undergraduate students who have not yet earned a bachelor’s or a professional degree. In order to apply for a Pell Grant, students must complete a Free Application for Federal Student Aid (FAFSA). The U.S. Department of Education uses a standard formula to evaluate the financial information provided on this application to determine a student’s eligibility for a Pell Grant. Award amounts vary based on a student’s financial need, an institution’s cost of attendance and enrollment status.

Federal Supplemental Educational Opportunity Grant (FSEOG) is a federal grant awarded to undergraduate students with exceptional financial need and does not have to be repaid. Funds are limited and Federal Pell Grant recipients receive priority. Students do not need to apply for this grant.

Florida Student Assistance Grant (FSAG) is a need based grant funded by the State of Florida available to full-time students who meet Florida residency requirements and enrolled in an associate or Bachelor`s Degree program. To be considered for this grant, the applicant must complete a Free Application for Federal Student Aid (FAFSA) in time to be processed error free by the deadline specified by the University for each of the Fall terms.

The EASE Grant provides financial support to full-time undergraduate students attending a private, non-profit university in the state of Florida. Student must be Florida residents and maintain an eligible GPA.

Keiser University participates in the federal student loan program which allows students and their parAents to borrow money to help meet their educational costs. Educational loans MUST BE PAID BACK with interest. Repayment begins 6 months after a student graduates or is no longer enrolled at least half time.

Direct Loans are low-interest loans and the lender/servicer is the U.S. Department of Education (the Department). The William D Ford Direct Loan Program offers the Direct Loans listed below:

Subsidized Direct Loans are loans for undergraduate students with financial need. Interest is not charged during in-school, deferment, and grace periods. The interest rate on Federal Direct Subsidized loans borrowed between July 1, 2025 – June 30, 2026 is 6.39%. If a student qualifies, the maximum amount of a Subsidized Stafford Loan is $3,500 for first-year students, $4,500 for second-year students and $5,500 for third-year and fourth-year students.

Unsubsidized Direct Loans are loans for both undergraduate and graduate students that are not based on financial need. Interest is charged during in-school, deferment, and grace periods. The interest rate on Federal Direct Unsubsidized loans borrowed by undergraduate students between July 1, 2025 – June 30, 2026 is 6.39% for graduate/professional students is 7.94%. Interest is charged on this loan from the time the loan is disbursed until it is paid in full. If allowed to accumulate, the interest will be added to the principal amount of the loan and increase the amount to be repaid. If a student qualifies, the maximum amount of an Unsubsidized Stafford Loan is $6,000 for first and second year students, $7,500 for third and fourth year students, $20,500 for graduate students. Award amounts are dependent upon a student’s dependency status on the Free Application for Federal Student Aid.

Federal Direct PLUS Loan Federal Direct PLUS Loan are low interest loans available to parents of dependent undergraduate students and graduate and professional students. It is an affordable, low-interest loan designed to help students and parents pay for a college education. Interest accrues on the Direct PLUS Loan from disbursement until it is paid in full. A mandatory credit check is completed as eligibility for this loan depends upon the borrower’s credit worthiness. Repayment of principal and interest begins 60 days after the loan is disbursed. The interest rate on Federal Direct PLUS and Grad Plus loans borrowed between July 1, 2025 – June 30, 2026 is 8.94%.

Keiser University Scholarship Programs

Keiser University offers a variety of scholarships ranging from academic to financial for students who meet the criteria set by the University. Recipients must be enrolled in an associate, bachelor, or master’s program.

Private Scholarships

Outside scholarships are awarded to students who meet the specific criteria of the scholarship benefactors. Scholarship committees usually choose scholarship recipients who have high grade point averages, large financial need and/or superior academic quantities.

Listed below are a few of the free resources available to help locate funding opportunities. The Financial Aid department can provide a listing of web sites for additional scholarships. Applicants can contact agencies located in their community for more information.

Additional information on financial aid programs offered at Keiser University is available by contacting the Financial Aid department at the campus a student plans to attend.

Keiser University maintains a full-time Director of Financial Aid at each campus to help meet your needs. You’re encouraged to make an appointment with the Financial Aid department to ensure that you obtain the funding needed for your educational investment. Financial Aid is available to those who qualify.

Financial aid is disbursed (released) to students in different ways depending on the type of aid and other factors. For more information about method and frequency of disbursements, contact the Financial Aid department.

To contact the Director of Financial Aid at each campus please call:

For more information on financial aid and scholarships, visit:

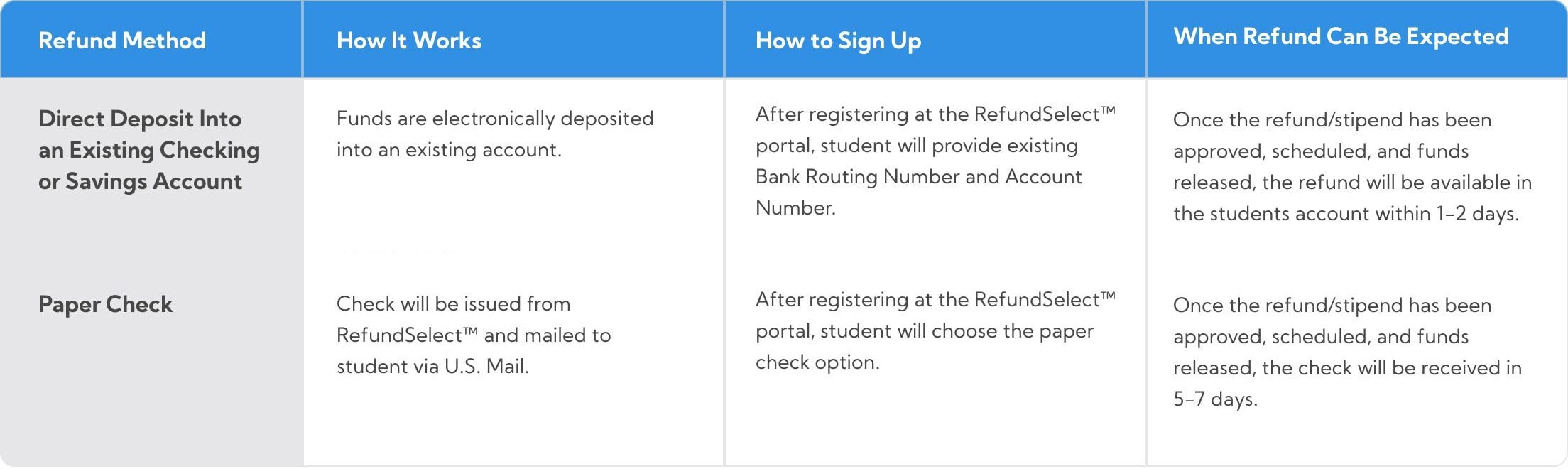

During your enrollment at Keiser University, you may at some time become eligible for a Financial Aid refund or other type of credit balance refund. Keiser University has partnered with Heartland ECSI to provide access to their RefundSelect™ program, which provides several options for you to choose from as to how you would like to have any eligible student account credit balance or refund disbursed to you.

Choose Your Refund Method

Within 48 hours of registering for school, a Welcome Email from Heartland ECSI will be sent to your:

• Keiser University student e-mail account, and

• Your personal email account, if one is provided to Keiser University

Click on the Get Started Here link in the email and enter your Heartland Key.

You will complete a basic registration and choose how you want to receive your money.

If you have an address or telephone number change, it must be made through your campus by contacting a school representative directly*.

Choose the Refund Method That’s Best for You

Note: If you have not registered and made a selection at the time the funds have been released, the refund method will default to paper check. You can always change the selection to another method at any time once you have registered.

Visit Heartland ECSI’s website for more information at heartland.ecsi.net or phone toll free at 1-844-760-6052.

For schools having 30 or more borrowers entering repayment in a fiscal year, the school’s cohort default rate (CDR) is the percentage of a school’s borrowers who enter repayment on certain Federal Family Education Loans (FFELs) and/or William D. Ford Federal Direct Loans (Direct Loans) during that fiscal year and default within the cohort default period.

Please refer to the Department of Education’s Cohort Default Rate Guide for a more in-depth description of cohort default rates and how the rates are calculated.